December 05, 2024

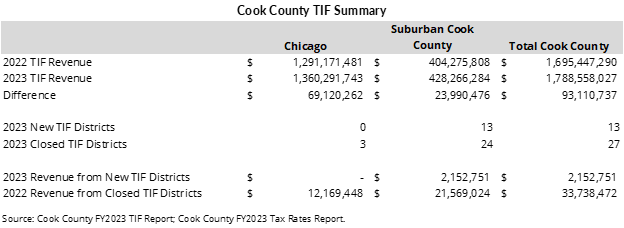

A report released by the Cook County Clerk in July 2024 found that revenue from Tax Increment Financing (TIF) districts in Cook County increased for a seventh straight year to nearly $1.8 billion, including approximately $1.4 billion in the City of Chicago and $428.3 million in suburban Cook County. The $1.8 billion total accounts for a 5.5% increase from tax year 2022, representing 9.7% of property taxes billed in the County.

TIF is a special funding tool used to generate funds for economic growth and development in a particular geographic area. A TIF district generates revenue from new developments or rising property values within its boundaries. Revenues can be used by the municipality for public works, to purchase and demolish buildings to make way for new construction, or as subsidies to promote private development. To learn more about TIFs, visit the Cook County Clerk’s FAQ page. For more information on TIF revenues and the use of TIF surplus funding in the City of Chicago, see the Civic Federation’s companion short analysis.

Twenty-seven TIF districts were closed in tax year 2023, most of which were in the suburbs and generated a collective $33.7 million in 2022. Thirteen new TIF districts were created in tax year 2023 and generated approximately $2.2 million. The table below summarizes property tax and TIF information for the City and suburban Cook County.

The Cook County Clerk’s Office’s annual TIF report provides information about revenues collected for each of the County’s 433 active TIF districts in the most recent tax year compared to the prior year. The County provides interactive maps that allow users to search for TIF data by district, address, and property identification numbers. It also provides a means to download and export that data. Users can also create their own maps through drawing and text tools.

City of Chicago Updates

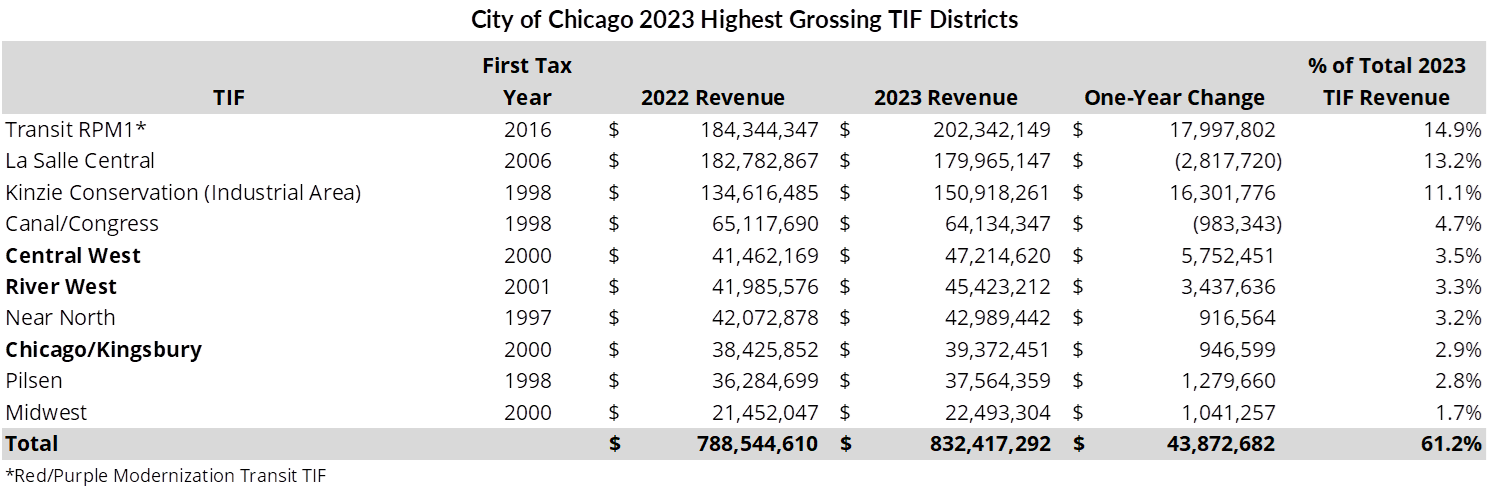

Revenues generated by the City of Chicago’s 124 active TIF districts increased from $1.3 billion in 2022 to $1.4 billion in 2023, an increase of 5.4%. As shown in the chart below, the ten highest-grossing districts in the City generated between $22.5 million and $202.3 million in revenue for the year. All but two of these districts experienced growth over 2022. However, three of the ten highest-grossing districts are set to expire in the next two years.

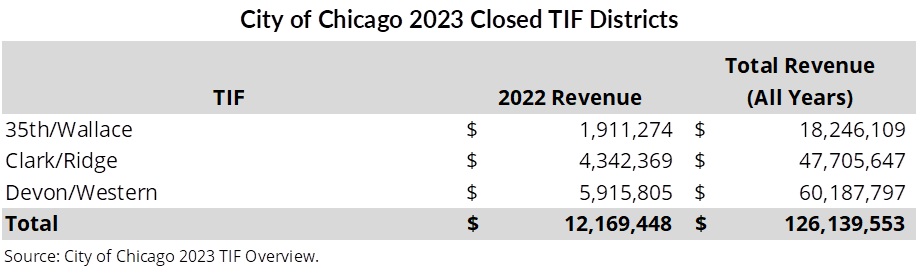

The City closed three TIF districts in 2023. As the table below shows, these three TIF districts generated nearly $12.2 million in 2022 and $126.1 million over their lifetimes. No new TIF districts were created in the City in 2023 and, as previously stated, the overall TIF revenue increased in tax year 2023 despite the closures.

Suburban Cook County Updates

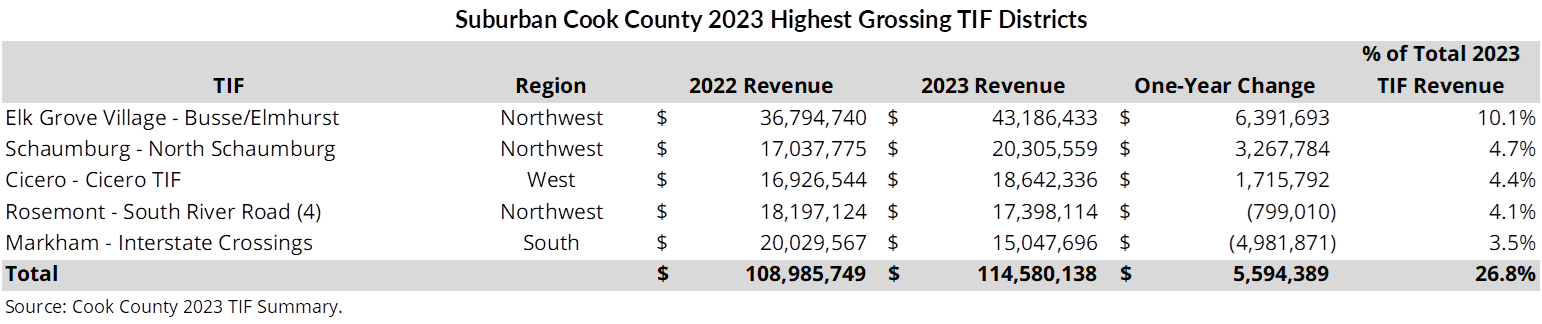

Although TIF revenue from the City of Chicago’s 124 active districts comprises 76% of the total TIF revenue in Cook County, there are 309 active TIFs in various suburban municipalities. TIF revenues in suburban Cook County saw a 5.9% increase over 2022. The table below shows the five highest-grossing TIF districts in suburban Cook County, three of which saw revenue increases from the prior year. These five districts collectively account for 27% of all suburban TIF revenue and account for $5.6 million in revenue growth over 2022.

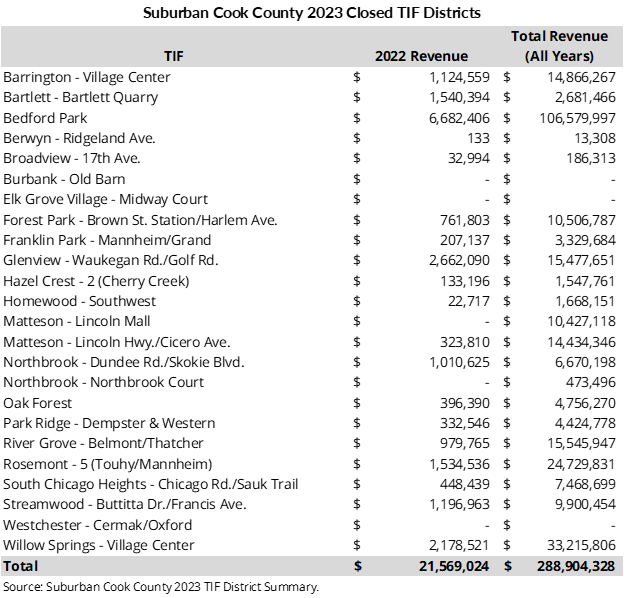

Twenty-four suburban TIFs were closed in 2023, as illustrated in the table below. Cumulatively, these 24 districts generated $21.6 million in 2022 and $288.9 million over their lifetimes.

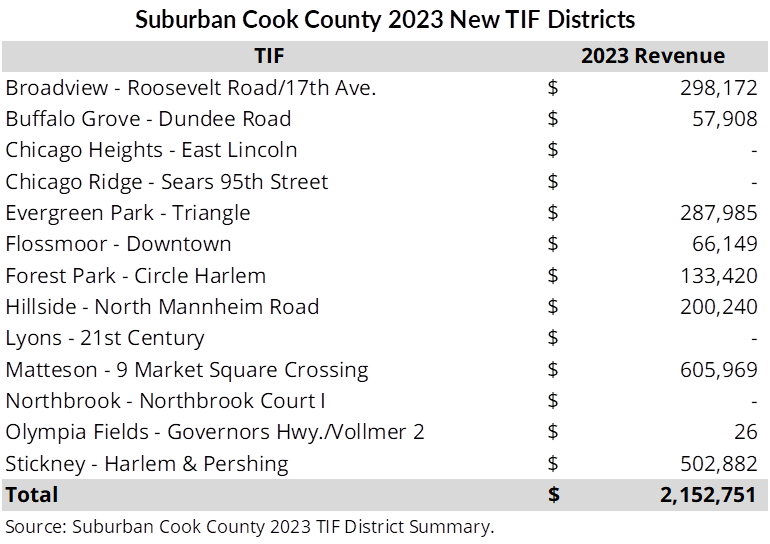

Additionally, 13 new TIFs were created in suburban municipalities in 2023, nine of which began generating revenue, as shown in the chart below. These districts generated nearly $2.2 million in their first year.

Related Links

“As Chicago Looks to Expiring TIF Districts for Increased Revenue, Here’s a Reminder of How TIF Works” (Civic Federation, April 11, 2024)