October 09, 2013

Four large local government pension funds in the Chicago area reduced their expected investment rates of return for fiscal year 2012. While intended to make the funds’ actuarial assumptions more realistic, these decisions will also have the effect of increasing the funds’ liabilities and reducing their funded ratios. The State of Illinois’ five retirement funds also recently reduced their expected investment rates of return and the Chicago Teachers’ Pension Fund trustees voted last month to reduce that fund’s expected rate of return for fiscal year 2013.

The assumed rate of return on investment, also called the discount rate, is used to calculate the present value of the future obligations of the systems. This is the amount that needs to be invested as of a specific date to provide benefit payments as they come due. Reducing the rate increases the present value of future commitments to employees and retirees and results in higher liabilities and lower funded ratios. To read more about the discount rate, read the Civic Federation’s Status of Local Pension Funding reports.

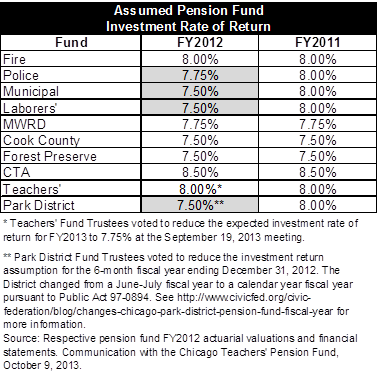

Three of the four funds are City of Chicago funds: the Police, Municipal and Laborers’ funds. The fourth is the Chicago Park District fund. The following chart shows the assumed rates of return in FY2011 and FY2012 for the ten local government pension funds the Civic Federation studies.

Actuarial assumptions and methods can change for various reasons, including demographic trend changes, analysis of recent plan experiences or new industry standards such as Governmental Accounting Standards Board (GASB) requirements. It is considered standard practice for actuaries to review and reassess assumptions, such as mortality rates, salary levels and expected rates of return every five years. The Laborers’ fund and Park District fund changed investment return and other assumptions as part of larger actuarial experience studies.

The following paragraphs summarize the impact of assumption changes on the unfunded liabilities and funded ratios of the four funds in FY2012,[1] as described in the actuarial valuations of the funds.

Police

-

Due to the reduction in the investment return assumption to 7.75% from 8.00%, the FY2012 unfunded liabilities of the fund increased by $256 million from where they would have been in FY2012 without the change.

-

Due to the reduction to the investment return assumption, the FY2012 funded ratio fell to 31.4% on a market value basis. The funded ratio would have been 32.3% in FY2012 without the change.

Municipal

-

Due to the reduction in the investment return assumption to 7.50% from 8.00%, the unfunded liabilities of the fund increased by $731 million from where they would have been in FY2012 without the change.

-

The funded ratio fell to 38.0% in FY2012 from 40.6% in FY2011 on a market value basis due to both the reduction in the investment return assumption AND contribution shortfalls.

Laborers'

-

Due to all of the assumption changes implemented by the Laborers’ fund for the FY2012 actuarial valuation, the unfunded liabilities of the fund increased by $130.4 million from where they would have been in FY2012 without the changes. The change in discount rate to 7.50% from 8.00% accounted for over 90 percent of the change in accrued liability.

-

The funded ratio fell to 57.7% in FY2012 from 60.0% in FY2011 on a market value basis due to both the updated assumptions that were recommended in the most recent experience study AND contribution shortfalls.

Park District

-

Due to the changes to actuarial assumptions and reduction in the investment return assumption to 7.50% from 8.00%, the unfunded liabilities of the fund on December 31, 2012 increased by $92.4 million from where they would have been without the changes.

-

Due to changes to actuarial and investment return assumptions, the funded ratio on December 31, 2012 fell to 43.4% on a market value basis. The funded ratio would have been 46.9% on December 31, 2012 without the changes.

[1] The Park District actuarial valuation is for the six-month short fiscal year ending December 31, 2012. Technically, the Park District fund’s fiscal year 2012 ended July 31, 2012. The Park District pension fund’s FY2013 will run from January 1, 2013 to December 31, 2013, matching the Park District’s 2013 fiscal year.