July 14, 2010

Almost immediately after the Illinois General Assembly approved an unbalanced budget for FY2011, two of the three major rating agencies downgraded the state’s debt ratings.

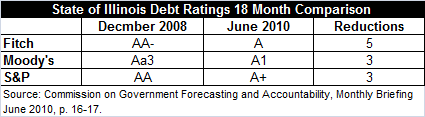

It was the fifth time in the last 18 months that Illinois has seen its ratings reduced by Fitch and the third reduction from Moody’s. Standard and Poor’s (S&P) has also reduced the State’s rating three times in the past 18 months but has not taken further action since January. All three agencies still consider Illinois’ debt as investment grade and not as speculative debt, but they also note that the State’s lower rating means that Illinois is more susceptible to adverse economic conditions in a time of continued global financial stress.

In its June Briefing newsletter, the Commission on Government Forecasting and Accountability provided a summary of the ratings dating back to June 2000 and the pertinent analysis that accompanied the downgrades. The following chart compares the State of Illinois’ General Obligation Bond (GO Bond) debt ratings in December of 2008 to the current ratings from each agency.

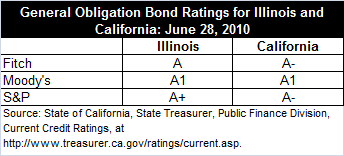

Illinois and California now have the lowest credit rating of any states from Moody’s and are only two steps above junk status. Fitch and S&P still consider Illinois’ debt slightly more attractive than California’s. The following compares all three major agencies’ current ratings for California and Illinois GO Bonds.

Although it is not the only factor, the debt rating is often the starting point in determining how much in interest cost the State will have to pay for issuing debt. Also under consideration during both negotiated sales and competitive sales of states’ GO Bonds are factors such as the size of the offering, other issuances also on the market, the amount of outstanding state bonds still available from previous sales and the prospects for the state’s future fiscal health compared to other issuers. The more negative the outlook in the State’s debt, including what can be gleaned from the ratings issued by Fitch, Moody’s and S&P that are provided for a fee at the time of issuance, the higher interest rates the market demands from the state for its debt.

However, despite these downgrades and negative analysis from the agencies over the past year and a half, the State has been able to take advantage of beneficial market conditions and is actually paying lower total interest cost for its debt now than it was prior to December 2008.

This apparent contradiction is primarily the result of a lower federal funds rate, which is the rate at which banks lend cash to other banks and financial institutions overnight through the Federal Reserve Bank. The target federal funds rate is widely used as the basis for other debt issued by both public and private entities. The target rate is set by the Federal Open Markets Committee and was reduced to between 0.0% and .025% in December 2008. The federal government dropped the rate, which had been as high as 3.5% earlier that same year as a reaction to the tightening of the global credit markets. The federal funds rate remains frozen at this level.

The ratings assigned to the government’s debt are major factors in determining how much the issuer will pay in interest above the federal funds rate, which is measured in basis points. One basis point is equal to .01%.

As was reported at the time of the State’s latest bond issuance in June 2010, the State paid 297 basis points above the comparable federal funds rate. In comparison, Illinois’ $300 million Build America Bond offering in April 2010, prior to the downgrade, had an interest rate 210 basis points over the federal funds rate. The federal funds rate itself was reduced by between 325 and 350 basis points over 12 months in 2008 and has remained at that level ever since.

Thus, due to the reduced federal funds rate, even with the lower credit rating and massively expanding budget deficit, Illinois’ total cost for issuing debt is lower than it was 18 months ago. However, as one of the lowest rated municipal bond issuers, the State is paying more in interest cost compared to most other governments, and investors must pay more if they choose to insure the debt against default. As reported in the Chicago Tribune, the State could pay roughly $9 million more per year in interest costs for its $900 million Build America Bonds sale on July 14, 2010 than other states with better credit ratings and fiscal outlooks also issuing the federally subsidized taxable bonds this week.

Illinois recently set a record for the highest price ever charged for municipal bond insurance. It now costs investors $301,100 to insure each $10 million of debt through purchasing derivatives known as Credit Default Swaps (CDS). Investors in California paid slightly less at $299,600 for every $10 million of debt it insured. Market experts suggest that the higher CDS cost shows how other factors than ratings affect the markets appetite for Illinois debt. Their commentary explains how potential investors also react negatively to Illinois’ chronically unbalanced budget, dependence on borrowing for operating revenue, and inaction on resolving the state’s fiscal crisis.