May 11, 2012

Faced with the threat of a significant budget gap in FY2013, the Illinois General Assembly has approved legislation that would reduce the State’s bill for retiree health insurance by shifting more of the costs to retirees.

Senate Bill 1313 passed the Senate on May 10, 2012 by a vote of 31 to 20. One day before, on May 9, the legislation passed the House by a vote of 74 to 43. The bill eliminates provisions of State law under which approximately 90% of the more than 80,000 retirees covered by the State’s group insurance program do not pay any healthcare premiums.

SB1313 gives the Illinois Department of Central Management Services (CMS) the authority to determine how much retirees will pay in premiums. CMS decisions would be subject to review by the General Assembly’s Joint Committee on Administrative Rules.

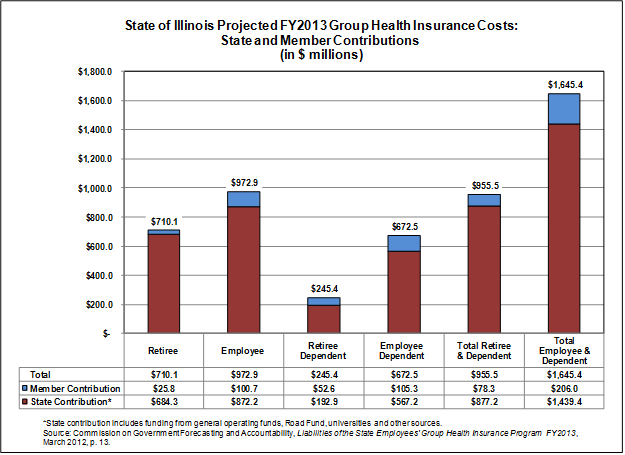

In FY2013 the State is expected to spend $684.3 million on healthcare coverage for retirees and another $192.9 million on coverage for retirees’ dependents, for a total of $877.2 million. All retirees are required to pay premiums for their dependents.

The General Assembly’s quick action on the bill—it was amended to address retiree healthcare just two weeks ago, on April 26, 2012—comes after years of discussion about whether the State’s retiree healthcare contributions are overly generous. Governor Pat Quinn proposed reducing the State retiree healthcare subsidy in his recommended budgets for both FY2010 and FY2011, but the proposals received little support from General Assembly members. As discussed here, the legislature’s Commission on Government Forecasting and Accountability in early 2011 hired a consulting firm to study the cost of retiree healthcare coverage in Illinois and to present recommendations for possible new premium structures.

At a meeting of the House Executive Committee on May 2, 2012, House Speaker Michael Madigan said he proposed increased retiree healthcare contributions partly in response to a request from the Governor’s Office that was related to the collective bargaining process. The Governor’s recommended FY2013 budget for the year beginning on July 1, 2012 assumes that State general operating costs for healthcare will be reduced by approximately $250 million. The issue is on the table in ongoing labor negotiations for contracts that begin on July 1, 2012. If healthcare costs are not reduced, the projected $162 million operating surplus in the Governor’s FY2013 budget would turn into an $88 million operating deficit.

The State’s largest union, Council 31 of the American Federation of State, County and Municipal Employees (AFSCME), strongly opposes SB1313. AFSCME maintains that the legislation interferes with the collective bargaining process and breaks a promise to retirees.

Retiree health insurance is also a component of the Governor’s pension reform proposal announced on April 20, 2012. The proposal offers employees a choice between their current plans and a new plan involving higher employee contributions, lower benefits and more stable funding. Employees who do not choose the new plan will lose, among other current benefits, the State subsidy for retiree health coverage. Employees who select the new plan will retain State support for retiree health insurance, but it is not clear whether State assistance will remain at the current level.

Under current law, State employees who retired before January 1, 1998 do not pay healthcare premiums. For those who retire after that date, the State contributes 5% of the premium cost for each full year of service, up to a maximum of 100% for retirees with 20 or more years of service. Exceptions include General Assembly members, who can retire with as few as four years of service and not pay any premiums, and judges, who can retire with as few as six years of service and not pay premiums. Retirees do incur out-of-pocket healthcare costs such as co-payments and deductibles.

The State Employees’ Group Insurance Program provides health insurance coverage to an estimated 357,738 participants, including employees, retirees and dependents, according to COGFA’s latest report on the program. Funding for the program comes from general operating funds, the State’s Road Fund, State universities, member contributions and other sources, including a retiree Medicare Part D prescription drug coverage subsidy from the federal government.

COGFA’s report indicates that health insurance coverage for retirees is expected to cost a total of $710.1 million in FY2013. Of that amount, $684.3 million, or 96.4%, comes from the State and $25.8 million, or 3.6%, comes from retiree contributions. Coverage for existing employees is expected to cost $972.9 million in FY2013. Employees will contribute $100.7 million, or 10.4%.

In the following chart, it should be noted that State contributions include non-member contributions from all of the funding sources cited above.

The chart shows that dependents of retirees pay 21.4% of the total cost of their health insurance premiums, while dependents of employees pay 15.7%. The total cost for retiree health insurance, including their dependents, is projected at $955.5 million, with the State paying $877.2 million, or 91.8% and retirees paying $78.3 million, or 8.2%.

The State makes contributions to the group insurance program on a pay-as-you go basis rather than prefunding future obligations to retirees. As of June 30, 2011, the program’s unfunded accrued liability for current and future retirees was estimated at $33.3 billion

SB1313 does not specify how retiree premiums will be determined, leaving that decision to CMS. At a hearing in the Senate Executive Committee on May 10, 2012, a CMS official said that retiree healthcare premiums, like other healthcare benefits, will be negotiated with the State’s unions.

A CMS memo to Minority Leader Tom Cross indicates that retirees are expected to pay premiums on a sliding scale based on length of job service and ability to pay. Specifically, the memo indicates retiree contributions will be based on the following guidelines:

• Premiums will be based on a retiree’s pension level, with pensions divided into seven tiers and those in the higher tiers paying higher premiums;

• Retirees covered by Medicare will pay lower premiums because the State pays less for their coverage;

• Current retirees will pay premiums based on their pension levels and given the most credit for years of job service; and

• No retiree will pay less under SB1313 than under current law.

SB1313 does not apply to the Teachers’ Retirement Insurance Program (TRIP) and the College Insurance Program (CIP), which cover retired teachers outside Chicago and downstate and suburban retired community college employees. Unlike most retirees in the State group health program, retirees in TRIP and CIP are required to pay premiums.

The Governor’s proposed FY2013 budget does not include State funding for TRIP or CIP. However, these contributions—$86.7 million to TRIP and $4.2 million to CIP—are covered by continuing appropriations under State law. Without a change in the law, the contributions will continue to be made.

TRIP and CIP had unfunded liabilities of $18.9 billion and $2.1 billion, respectively, as of June 30, 2011.