March 03, 2016

With the budget for the current fiscal year still incomplete, Governor Bruce Rauner proposed a financial plan for the next budget year with an operating deficit of $3.5 billion.

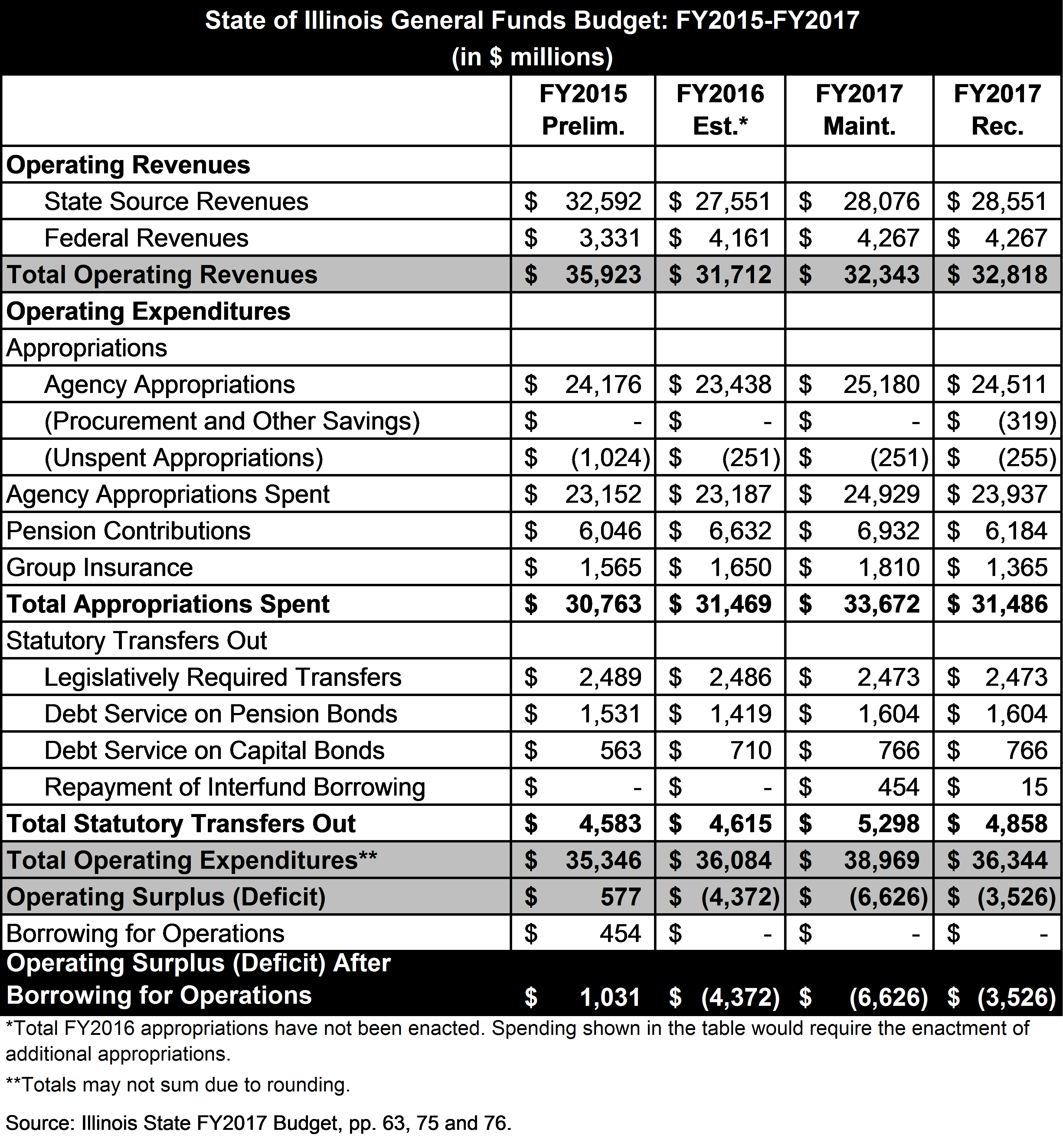

The proposed budget for fiscal year 2017, which begins on July 1, 2016 and ends on June 30, 2017, was issued on February 17, 2016. The recommended FY2017 budget includes general operating revenues of $32.8 billion and expenditures of $36.3 billion.

Rather than providing a specific plan to close the $3.5 billion gap between revenues and expenditures, the proposed FY2017 budget offers the General Assembly a choice between two options:

- Agreeing to key portions of Governor Rauner’s Turnaround Agenda, which is intended to boost economic growth by making Illinois more appealing to businesses. In that case, the Governor would support unidentified additional revenues and spending that could reach $36.3 billion; or

- Granting the Governor broad authority to close the $3.5 billion gap on his own by making cuts to any area of government, with limited exceptions such as debt payments and education funding, and by reducing reimbursement rates for healthcare and human services providers. In that case, spending could be as low as $32.8 billion.

The recommended FY2017 budget does not address the continuing budget impasse in FY2016, although an operating deficit of $4.4 billion in FY2016 is shown in the budget document. The estimated results in FY2016 would require additional appropriations for areas of government that are not currently being funded, including higher education, certain human services programs and group health insurance.

The following table summarizes the proposed General Funds budget for FY2017. It also shows preliminary results for FY2015; estimated results for FY2016; and an FY2017 maintenance budget, which is defined in the budget document as the amount needed to fund agencies’ core missions and programs, after adjusting for price changes and one-time costs.

The budget document includes a line worth $3.5 billion labeled “Working Together or Executive Management,” representing the two proposed options for closing the shortfall. This amount brings the operating deficit to zero and satisfies the requirement in the Illinois Constitution that the Governor present a balanced budget, according to the administration.

As explained here, Illinois’ budgets for FY2015, FY2016 and FY2017 have been challenging because of the partial rollback of a temporary income tax rate increase enacted in 2011. Individual income tax rates, which were increased to 5.0% from 3.0%, dropped to 3.75% on January 1, 2015; corporate income tax rates, which were raised to 7.0% from 4.8%, fell to 5.25%. Corporations also pay a Personal Property Replacement Tax of 2.5%, which is a revenue source for local governments. Largely as a result of the reduction in income tax rates, income tax revenues are projected to decline by $4.8 billion, or 24.5%, from $19.8 billion in FY2014 to $15.0 billion in FY2017.

Some of the projected revenue losses in the proposed FY2017 budget are offset by a total of $475 million from two one-time sources. The budget recommends spending down the entire $275 million balance in the Budget Stabilization Fund, the State’s only rainy day fund. An estimated $200 million from the proposed sale of the James R. Thompson Center is also included in FY2017 resources.

Proposed FY2017 expenditures of $36.3 billion are $2.6 billion below the FY2017 maintenance budget of $39.0 billion. The proposed savings include the following:

- Pensions: Contributions to the State’s five retirement systems would total $6.2 billion, which is $748 million below the amount currently required by State law. The savings would mainly come from shifting pension costs to local school districts and universities and by recalculating pension liabilities to lower current expenses.

- Group Health Insurance: Payments would be reduced by $445 million, or 24.6%, by giving employees a choice between significantly higher premiums or less generous coverage. The proposed changes have so far been rejected by the American Federation of State, County and Municipal Employees (AFSCME) in negotiations over a new contract to replace an agreement that expired on June 30, 2015; the Rauner administration is currently seeking a determination from the Illinois Labor Relations Board on whether the talks have reached an impasse. The budget proposes that health insurance benefits be removed from collective bargaining.

- Education: Funding for higher education is reduced by $200 million, but spending on elementary and secondary education and early childhood education is increased by a total of $103 million.

- Community Care Program: Spending on this program, which aims to keep seniors out of nursing homes, is cut by $197 million, or 22.6%. The administration plans to use less costly services for individuals who are not eligible for Medicaid.

- Interfund Borrowing: The Governor recommends repaying only $15 million of the $454 million borrowed from other State funds at the end of FY2015. Repayment had been due within 18 months, before the end of FY2017.

- Other: Additional savings would come from freezing general and experience-based pay increases while establishing a merit pay plan and by centralizing and streamlining the procurement process.

Even after these changes, the proposed FY2017 budget would still be out of balance by $3.5 billion.

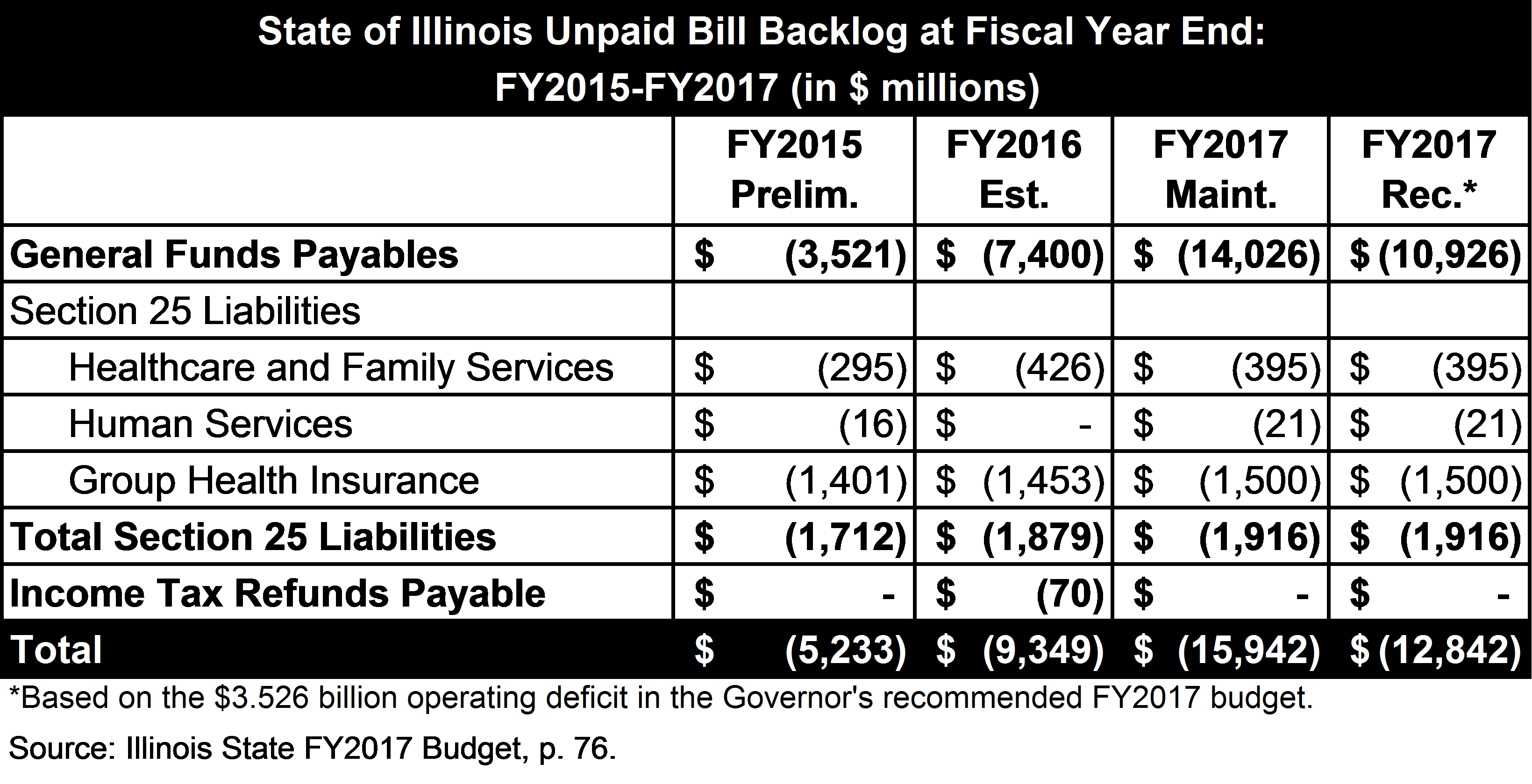

The next table shows the State’s backlog of unpaid bills from FY2015 to FY2017. The State ended FY2015 with $5.2 billion in unpaid bills, according to the budget document. If additional appropriations are enacted with no additional revenues, the backlog is expected to reach $9.3 billion at the end of FY2016. At maintenance spending levels, unpaid bills could grow to $15.9 billion at the end of FY2017. Under the Governor’s proposed budget, the backlog could be $12.8 billion at the end of FY2017 if the operating deficit of $3.5 billion is not closed through either of the options presented in the budget and $9.3 billion if the deficit is closed.

In the table, General Funds payables are bills and payments owed to vendors, State agencies and local governments that are paid during the lapse period. The lapse period is the time during which this year’s bills may be paid with next year’s revenues. Most bills are due to the Comptroller by two months after the end of the fiscal year, but the Comptroller has until December 31 to pay them.

Under State law, most bills must be paid based on the current year’s spending authority. However, exceptions to Section 25 of the State Finance Act permit the payment of certain bills based on future years’ appropriations. These bills are known as Section 25 liabilities. The authority to defer Medicaid bills at the Department of Healthcare and Family Services was sharply restricted beginning in FY2013; group health insurance bills currently represent the major Section 25 liability.

The table shows $70 million in unpaid income tax refunds at the end of FY2016, but that backlog is likely to grow to several hundred million dollars, according to testimony on March 1 at a hearing of the General Assembly’s Commission on Government Forecasting and Accountability. The current diversion rates—the percentage of individual and corporate income taxes diverted from General Funds to pay income tax refunds—are too low to cover estimated refunds for FY2016. Without an FY2016 budget in place, the diversion rates were determined by statutory formula.

The table does not include approximately $64 million in back wages owed to union employees as a result of a dispute over cancelled raises. A Cook County Circuit Court judge in December 2012 ordered the State to pay the back wages when funds were available, and former Governor Pat Quinn agreed to make the payments as part of contract negotiations with AFSCME, the State’s largest union.