November 18, 2010

A new report by the Civic Federation’s Institute for Illinois’ Fiscal Sustainability (IIFS) shows why the State of Illinois is struggling to make its roughly $4 billion pension contribution in FY2011.

The report reviews the State’s $53.5 billion operating budget for the current fiscal year, which began on July 1, 2010 and ends on June 30, 2011. The report focuses on the $25.8 billion General Funds budget, the largest component of the operating budget and the part of the budget over which the State has the most discretion and control. The other components of the budget consist of Other State Funds, accounts for activities funded by earmarked revenue sources that may only be used for specific purposes and Federal Funds, funds from the federal government (other than those designated for General Funds) that support a variety of state programs.

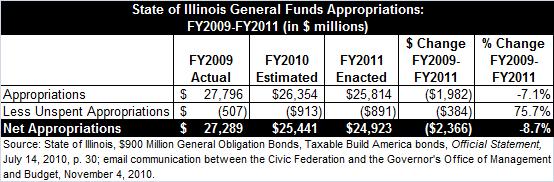

The table below shows that General Funds appropriations declined by 7.1%, or $2.0 billion, from $27.8 billion in FY2009 to $25.8 billion in FY2011. Net appropriations—appropriations reduced by subtracting out unused spending authority—are expected to drop 8.7%, or $2.4 billion, from $27.3 billion to $24.9 billion.

For FY2011 unspent appropriations from General Funds reflect $891 million in reserves imposed by the Governor under the Emergency Budget Act of FY2011. The Emergency Budget Act authorized the Governor to require reserves of up to roughly $1.6 billion, which cannot be spent unless released by the Governor or upon passage of new revenue sources. Unspent appropriations from General Funds in FY2010 will not be determined until the end of the lapse period. The lapse period, the period of time in the current fiscal year in which the State may pay bills from the previous fiscal year, usually lasts two months. However, because of cash flow problems, the State has allowed itself six months in FY2011—until December 31, 2010—to pay bills from FY2010.

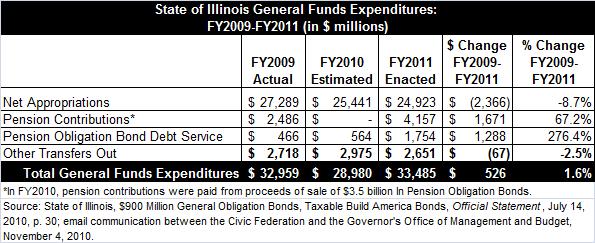

General Funds are also used to make statutorily required transfers to other funds, including amounts dedicated to debt service and payments to local governments. The State has typically used General Funds to make pension contributions required under the funding schedule in Illinois’ 1995 pension reform law. In FY2010 the State made its required contributions to Illinois’ five retirement systems by issuing $3.5 billion in Pension Obligation Bonds. The pension payment for FY2011, certified at $4.2 billion, is not currently included in General Funds appropriations. The Illinois Senate is expected to consider a pension borrowing plan that was previously passed by the House of Representatives during the veto session that began on November 16, 2010. Under state law, pension contributions are covered by continuing appropriations if not otherwise provided for in the budget.

Total expenditures from General Funds—including appropriations, transfers and pension payments—will increase by 1.6%, or $526 million, from FY2009 to FY2011 if the pension borrowing is not approved. Higher expenditures for pension contributions and debt-service payments will more than offset reductions in annual appropriations.

While expenditures from General Funds total $33.5 billion in FY2011, General Funds revenues in the current fiscal year are projected at $27.7 billion. General Funds expenditures do not include any amounts to cover the State’s accumulated deficit from prior years of $6.5 billion.

As discussed in both the new IIFS report and in this blog last week, additional state borrowing to make the FY2011 pension contributions would lighten the load on General Funds this year but would lead to dramatically higher debt service payments for almost a decade.