September 26, 2013

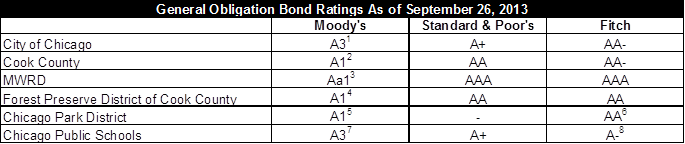

Since July 2013 each of the six local governments monitored by the Civic Federation with General Obligation bond debt has experienced downgrades to their bond ratings. These governments are the City of Chicago, Cook County, the Metropolitan Water Reclamation District (MWRD), the Forest Preserve District of Cook County, the Chicago Park District and Chicago Public Schools. In the past three months, Moody’s Investors Service issued downgrades for each of the six local governments, and Fitch Ratings downgraded two of the governments: Chicago Public Schools and the Chicago Park District. Ratings from Standard and Poor’s for these six governments did not change in the past three months.

The chart below shows the General Obligation bond ratings as of September 26, 2013 for these six local governments. You can access the ratings reports from the ratings agencies by clicking the links below (free registration is required to read the agencies’ reports).

Note 1: July 17, 2013 - Moody’s triple-downgraded the City of Chicago to A3 from Aa3 with a negative outlook.

Note 2: August 16, 2013 - Moody's downgraded Cook County to A1 from Aa3 with a negative outlook.

Note 3: August 27, 2013 - Moody's downgraded the MWRD to Aa1 from Aaa with a negative outlook.

Note 4: August 29, 2013 - Moody's downgraded the Forest Preserve District of Cook County to A1 from Aa2 with a negative outlook.

Note 5: July 24, 2013 - Moody's downgraded the Chicago Park District to A1 from Aa2 with a negative outlook.

Note 6: August 2, 2013 - Fitch downgraded the Chicago Park District to AA from AAA with a negative outlook.

Note 7: July 24, 2013 - Moody's downgraded the Chicago Board of Education (Chicago Public Schools) to A3 from A2 with a negative outlook.

Note 8: September 23, 2013 - Fitch downgraded the Chicago Board of Education (Chicago Public Schools) to A- from A with a negative outlook.

In Moody’s and Fitch’s reports accompanying the downgrades, the ratings agencies cited two specific rationale for all six of the governments.

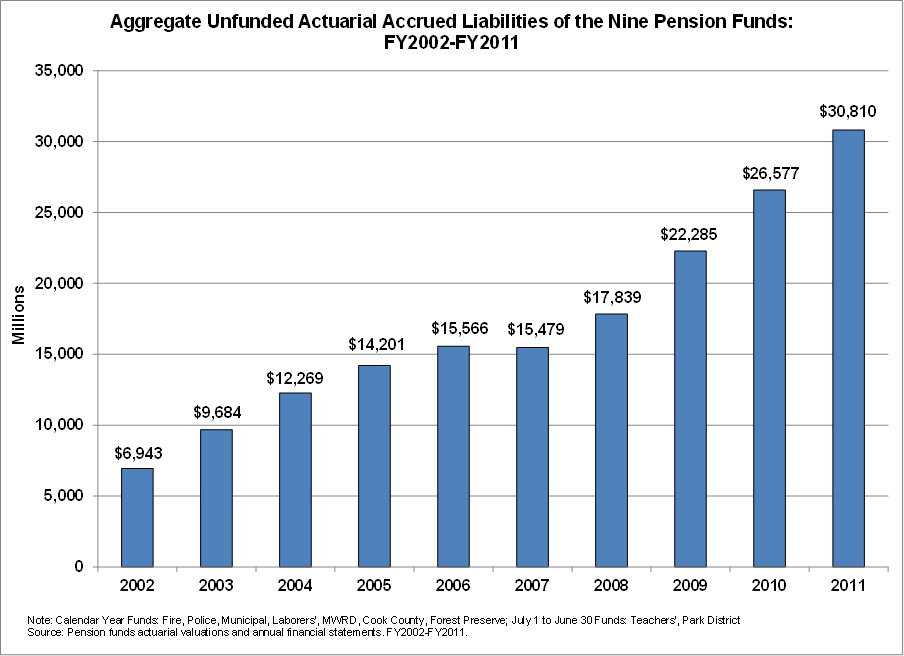

1) Significant and growing pension liabilities – The aggregate unfunded actuarial accrued liabilities for the nine pension funds of the six local governments that experienced downgrades totaled $30.8 billion in FY2011. This is an increase of $23.9 billion, or 343.8%, in the ten years since FY2002.

The nine funds include the City of Chicago’s four pension funds (Municipal Employees’ Annuity and Benefit Fund of Chicago, Laborers’ and Retirement Board Employees’ Annuity and Benefit Fund of Chicago, Firemen’s Annuity and Benefit Fund of Chicago and Policemen’s Annuity and Benefit Fund of Chicago), the County Employees’ and Officers’ Annuity and Benefit Fund of Cook County, the Forest Preserve District Employees’ Annuity and Benefit Fund of Cook County, Metropolitan Water Reclamation District Retirement Fund, Public School Teachers’ Pension and Retirement Fund of Chicago (CPS) and the Park Employees’ & Retirement Board Employees’ Annuity and Benefit Fund (Chicago Park District).

In addition, each of the pension funds for the six local governments that experienced downgrades have funded ratios that have fallen dramatically in the past ten years. In FY2011 each of these pension funds had funded ratios below 65%.

The ratings agencies explained that underfunding the pension systems, or contributing less than the actuarially calculated annual required contribution (ARC), is a main driver of the funds’ increasing liabilities.

2) Shared tax base with the City of Chicago – As the first in a series of downgrades, on July 17, 2013, Moody’s issued an unprecedented triple-downgrade of the City of Chicago’s General Obligation bond rating to A3 from Aa3. In the subsequent downgrades for the other Chicago-area local governments that followed, Moody’s and Fitch cited concerns that the City of Chicago, Cook County, the Forest Preserve District of Cook County, the MWRD, the Chicago Park District and Chicago Public Schools share an overlapping tax base. The fact that all of these governments with underfunded pensions must access the same tax base impacts their abilities to access revenue, and therefore, their bond ratings.

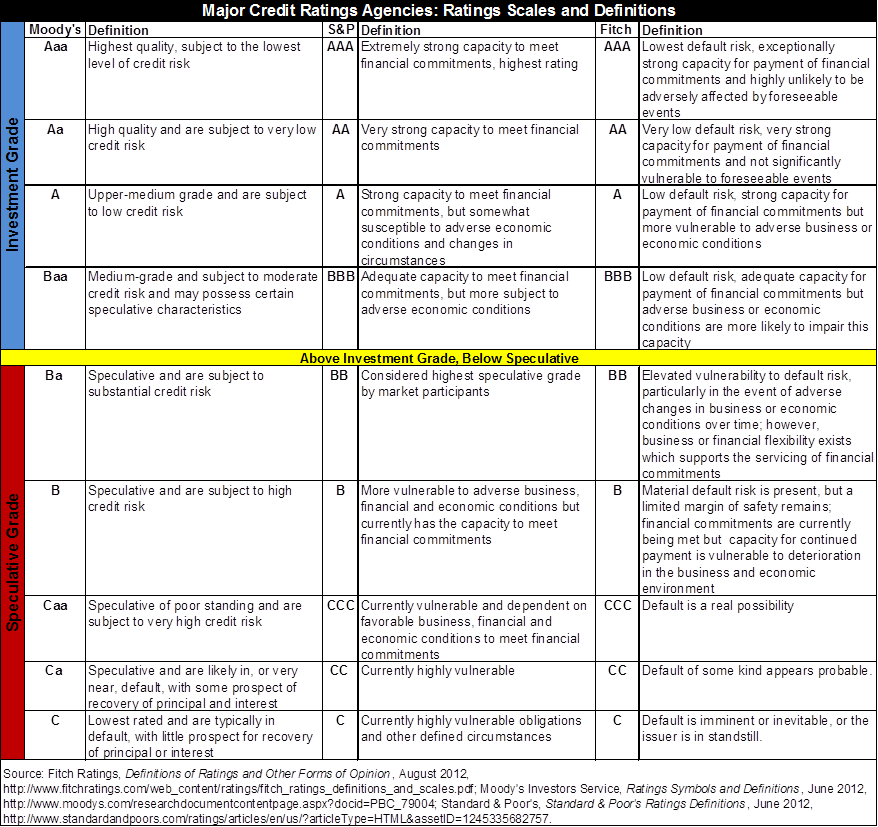

Rating Scales and Definitions:

The chart below shows the letter ratings and definitions for each level of bond as described by each ratings agency. Within each letter rating the agencies have three grades of credit. Both Fitch and S&P use a plus sign, no sign and minus sign to delineate where within a letter grade the credit stands. Moody’s system is slightly different and includes the numbers 1, 2 and 3 to show a credit’s stratification within a particular letter grade (1 being the highest quality and 3 the lowest). For more information on ratings agencies rating scales and definitions, click here.