February 14, 2014

At a recent committee hearing, Illinois lawmakers were provided with a mixed message regarding the economy and State budget for the coming fiscal year. Officials from the Illinois Department of Revenue explained that although the State could expect improved underlying economic growth in the next two years, operating resources would still plummet in the next year due to current tax policy.

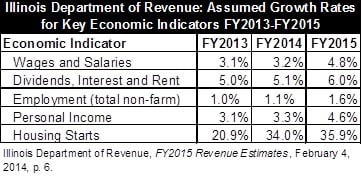

Many of the key indicators the Revenue Department uses as the basis for its General Funds revenue projections show sustained and improving growth from FY2013 to FY2015. These economic forecasts are provided by the consulting firm IHS Global Insight.

The following table shows the growth rates for some of the key economy indicators in Illinois from FY2013 through FY2015.

Despite the improvements in the broader Illinois economy, the State is expecting a decline in operating revenue totaling $3.9 billion or 10.6% over the next two fiscal years.

As previously discussed here, the contradiction in Illinois’ economic performance and State government’s bleak budgetary outlook is not a surprise. The loss of revenue is the result of the partial rollback of increased income tax rates approved in FY2011, which is scheduled to take place halfway through FY2015. On January 1, 2015, the State’s individual income tax rate will decline to 3.75% from 5.0% and the corporate income tax rate will decline to 5.25% from 7.0%.

As recently as January 1, 2014, when the Governor’s Office of Management and Budget published its three-year projections for the State budget, the revenue cliff was estimated to reduce General Funds revenues by $1.2 billion in FY2015. Total operating revenues were projected to fall to $35.2 billion from the FY2014 total of $36.4 billion. In FY2016, the first full year of the lower rates, revenues were projected to decline by an additional $2.4 billion to $32.8 billion for an aggregate two-year loss of $3.6 billion in General Funds revenues.

On February 4, 2014 the Revenue Department presented a preliminary update of its estimates for FY2014 revenues, increasing the total revenue estimate to $36.7 billion. The majority of the increase was attributable to a $270 million jump in income tax revenues from just over $16.0 billion to $16.3 billion. The FY2015 revenue projections did not change significantly in the update, declining by only $34 million. The upward revision of the FY2014 estimates increases the total revenue cliff in FY2015 to $1.6 billion. New projections for FY2016 were not made available, but based on the original FY2016 projection provided by the Governor’s office the total two-year loss increases to $3.9 billion.

The State of Illinois heads into this loss of resources still recovering from the financial crisis that began in FY2009 when the global recession severely reduced tax revenues over several years. Although the increase in income tax revenues since FY2011 helped the State to balance its operating budgets for the past few years, it still maintains an accumulated backlog of bills from previous years totaling $5.5 billion at the end of FY2014.

The House Revenue and Finance Committee began holding joint meetings with the State Government Administration Committee in January to tackle the issue of the State’s tax policy and the looming revenue cliff. The subject matter hearings have focused on collecting data from government offices including the Revenue Department, the Commission on Government Forecasting and Accountability and the Department of Commerce and Economic Opportunity. Tax policy experts, academics and business groups have also been called to testify. The committees have discussed how current State tax rates and policies affect the annual revenues and the cost of tax incentives granted to businesses for economic development. After the meeting on February 4, the committee chairs —Rep. John Bradley of the Revenue and Finance Committee and Rep. Jack Franks of the State Government Administration Committee – pledged to halt any additional tax incentive proposals until after the hearings are complete at the end of the spring legislative session. The committees aim to reform how the State administers its economic development programs, specifically focused on the Economic Development for a Growing Economy tax credit program, or EDGE.

The next joint committee hearing will be held on February 18, 2014, and is expected to focus on the FY2015 General Funds revenue estimates. For the last several years the revenue estimates developed in the House have been the basis for the spending limits used to guide the General Assembly’s budget deliberations for the coming fiscal year. Last year the Governor’s budget was preempted by the approval of a House revenue estimate that conflicted with the Governor’s estimate the day prior to his budget address. This year the General Assembly approved a request by the Governor to move the budget deadline from February 19 to March 26, after the spring primary held on March 18. However, House Speaker Michael Madigan has reportedly said that the General Assembly will continue developing its budget for FY2015 despite the delay in the Governor’s budget proposal.