July 31, 2014

According to recent reports, the State of Illinois’ operating revenues, which are expected to decline this year due to the partial rollback of State income tax rates, exceeded expectations in FY2014, the last full year of the increased income tax rates.

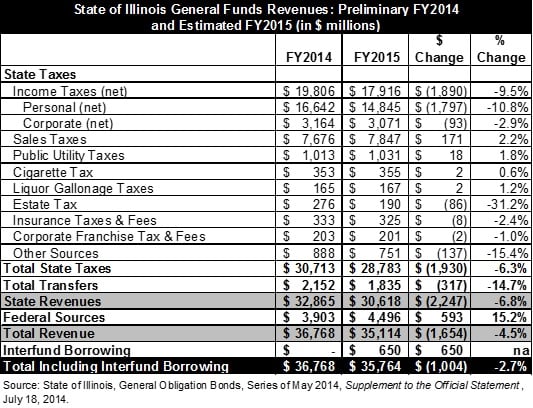

Documents published by the State to update bond disclosures include preliminary results for FY2014, which ended on June 30. The new data show FY2014 General Funds revenues totaled $36.8 billion, which represents an increase of $1.3 billion from the estimate of $35.4 billion used by the General Assembly during its budget deliberations in May 2013. The updated revenue total is also $43 million higher than the estimate of $36.7 billion in the Governor’s FY2015 recommended budget, which was issued on March 26, 2014.

The preliminary results for income tax revenues improved more than any other source from the legislative projections passed in House Resolution 389 on May 31, 2013. General Funds revenues from income taxes increased by $839 million to $19.8 billion in FY2014 compared to the original projection of $19.0 billion. Sales taxes increased by $328 million to $7.7 billion in FY2014 from $7.3 billion in the legislative estimate.

The following table shows the original General Funds revenue estimates for FY2014 used by the General Assembly to develop its FY2014 spending plan, the revised estimates published in the Governor’s recommended FY2015 budget and the preliminary results made available after the close of the fiscal year.

After a one-time surge in April 2013 that led to an increase of more than $1.0 billion in revenues for FY2013, it was unclear how FY2014 would compare. This led to the General Assembly’s conservative projection for FY2014, which was actually below the FY2013 total of $36.4 billion. Preliminary results show total General Funds revenues in FY2014 exceeded FY2013 revenues by $405 million, or 1.1%.

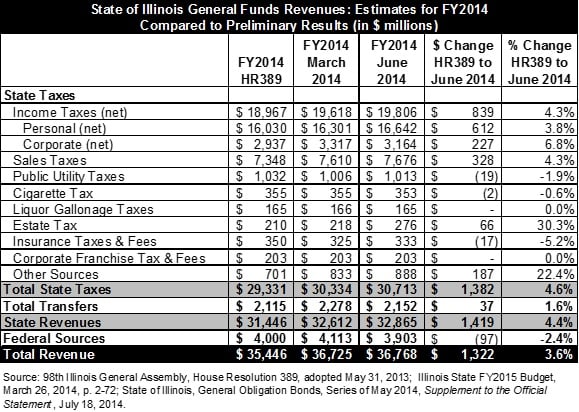

Despite the improvement in FY2014, the State’s revenue picture is overshadowed by the expected decline in FY2015. The FY2015 budget, approved by the General Assembly and signed earlier this month by the Governor, resorts to a series of gimmicks to cope with a $1.9 billion revenue decline from the partial rollback of the increased income tax rates.

As previously discussed here, $600 million of the FY2014 revenues will be used to pay for FY2015 Medicaid expenses. The State also approved interfund borrowing of $650 million to help close the FY2015 budget gap. Excluding this borrowing, the State’s General Funds revenues are currently estimated to decline to $35.1 billion in FY2015 from $36.8 billion in FY2014.

The following table compares preliminary results for General Fund revenues in FY2014 to the current estimates for FY2015.

In 2011 the State passed a temporary income tax increase after the economic recession resulted in several years of significantly reduced tax revenue. The legislation increased income tax rates on January 1, 2011 to 5.0% from 3.0% for individuals and to 7.0% from 4.8% for corporations (the State also collects a 2.5% personal property replacement tax on corporate income that is passed on to local governments). The rates are scheduled to decline on January 1, 2015 to 3.75% for individuals and 5.25% for corporations.

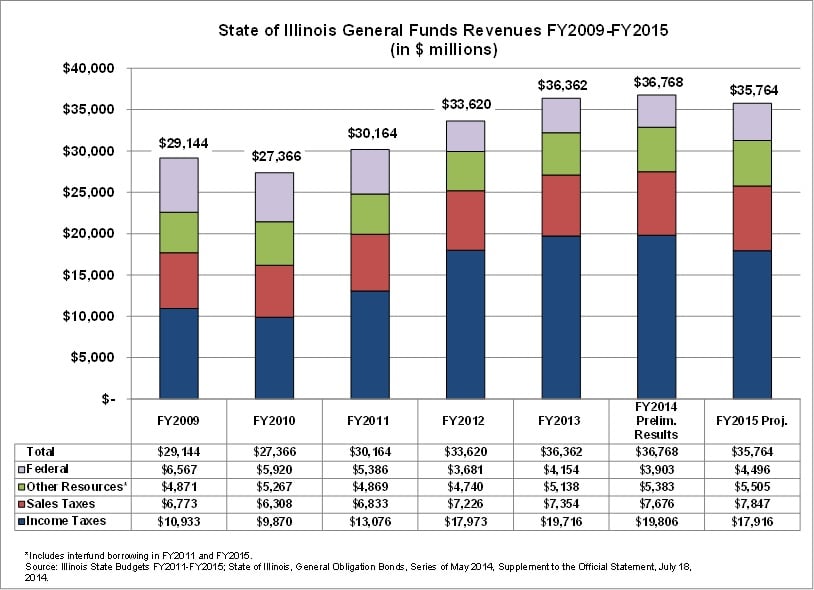

Prior to the income tax increase, General Funds revenues had declined by $1.8 billion to $27.4 billion in FY2010 from $29.1 billion in FY2009 and were not projected to rebound in FY2011. State-source revenues declined by $1.1 billion, or 4.9%, in FY2010 to $21.4 billion from $22.6 billion in FY2009. Between FY2009 and FY2010, income taxes declined by $1.1 billion to $9.9 billion from $10.9 billion and sales taxes declined by $465 million to $6.3 billion from $6.8 billion

It should be noted that $647 million of the General Funds decline in FY2010 was attributable to reduced federal revenues. Federal revenues deposited into General Funds consist mainly of reimbursements for State Medicaid spending. Federal reimbursement rates for Medicaid increased beginning in FY2009 under the federal stimulus plan known as the American Recovery and Reinvestment Act of 2009 (ARRA). To receive the enhanced reimbursement rates, states were required to make Medicaid payments to certain healthcare providers within 30 days. As a result, Illinois appropriated additional funds in FY2009 to pay down old Medicaid bills.

After income tax rates were increased halfway through FY2011, General Funds revenues grew by $9.4 billion, or 32.3%, to $36.8 billion in FY2014 from $27.4 billion in FY2010. This growth occurred despite a decline in federal revenues to $3.9 billion in FY2014 from $5.9 billion in FY2010 due to the expiration of ARRA.

State-source revenues grew by $11.4 billion, or 53.3%, to $32.9 billion in FY2014 from $21.4 billion in FY2010. Income tax revenues doubled to $19.8 billion in FY2014 from $9.9 billion in FY2010, mainly due to the higher rates but also to modest economic growth. Sales tax revenues increased by $1.4 billion, or 21.7%, to $7.7 billion in FY2014 from $6.3 billion in FY2010.

The partial rollback of the increased rates on January 1, 2015 will result in a decline in income tax revenues of $1.9 billion to $17.9 billion in FY2015 from $19.8 billion in FY2014. Since the rates are reduced halfway through the year, the FY2016 revenues are expected to decline even further. The projections for FY2016 were not updated in the latest State budget disclosures but were estimated to decline to $14.5 billion in the five-year projections issued by the Governor in March 2014.

The following chart shows total General Funds revenues from FY2009 to FY2015. The chart illustrates the loss in State revenues due to the economic downturn, growth due to the increased income tax rates and the initial loss when the increases partially roll back.