August 26, 2014

The difference between a pension fund’s assets and accrued liabilities is known as the unfunded liability. The unfunded actuarial accrued liability (UAAL) is calculated by subtracting the actuarial value of the assets from the actuarial accrued liability (AAL) of each fund.

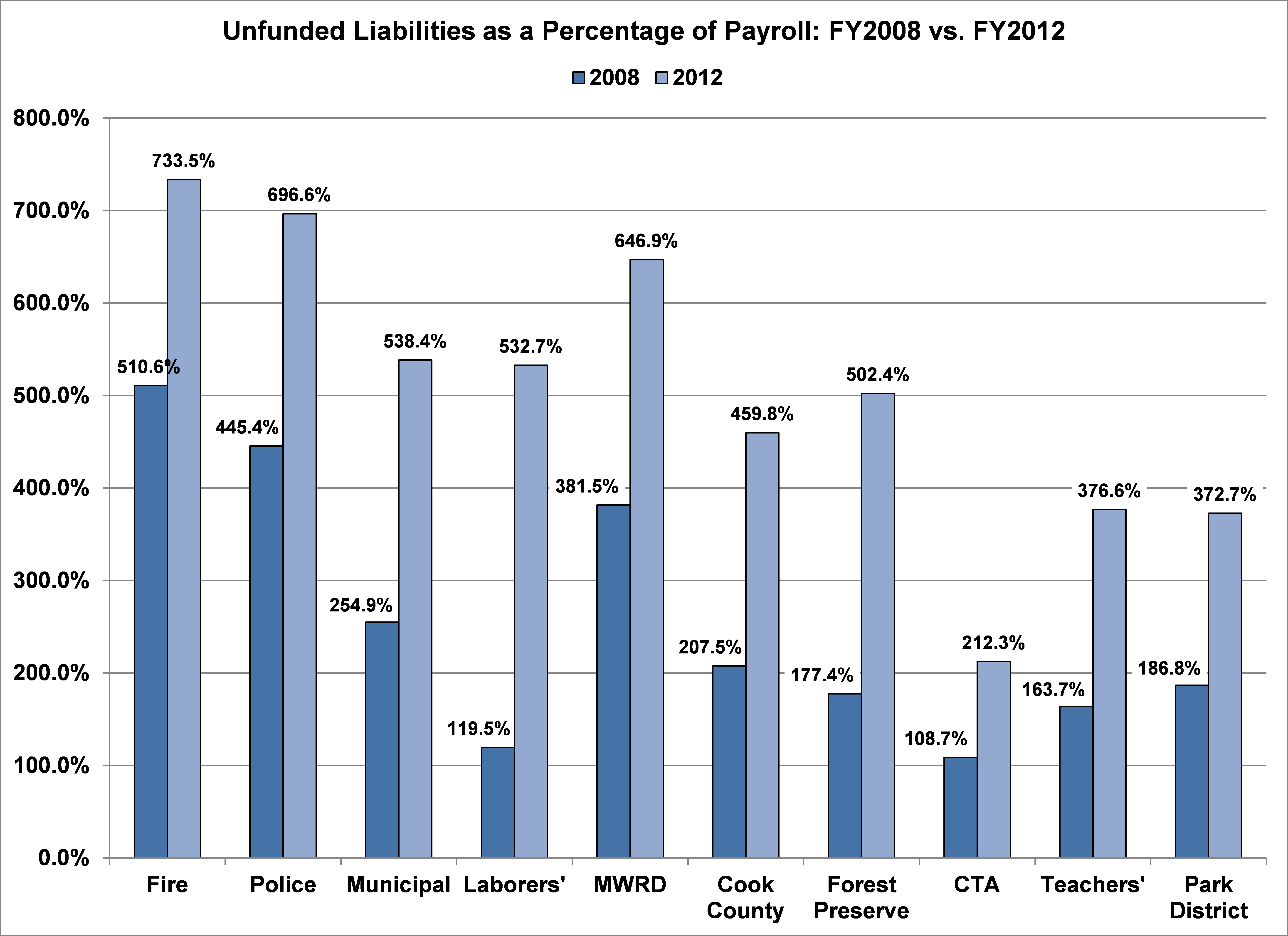

One of the functions of this indicator is to measure a fund’s ability to bring assets in line with liabilities. Healthy funds are ones that are able to reduce their unfunded liabilities over time while substantial and sustained increases in liabilities are a cause for concern. Another indicator of funding progress is a fund’s UAAL expressed as a percentage of covered payroll. This measurement demonstrates the relative size of the unfunded liability by expressing it in terms of current personnel expenditures.

An indication of a reasonable funding strategy is a gradual decrease in unfunded liabilities as a percentage of covered payroll over time. If the opposite is true and unfunded liabilities continue to increase as a percentage of covered payroll, as shown for ten local government pension funds in the Chicago area in the chart below, then a new funding strategy and a reduction in the level of benefits granted by the fund may need to be implemented. Such changes have been included in pension reform legislation passed for the Chicago Municipal and Laborers’ Funds and the Chicago Park District Fund and the funding changes passed for the MWRD. Cook County and the Forest Preserve District of Cook County proposed their own set of pension benefit and funding reforms, supported by the Civic Federation, but the legislation did not pass both houses of the General Assembly before the end of the spring session.

All ten local government funds the Civic Federation examined in our forthcoming Status of Local Pensions report experienced a significant increase in unfunded liabilities as a percentage of payroll between FY2008 and FY2012. The Fire Fund had the highest unfunded liabilities as a percentage of payroll, at 733.5% in FY2012, followed by the Police Fund at 696.6%. The Laborers’ Fund experienced the largest growth in its unfunded liabilities as a percentage of payroll, increasing by 413.2 percentage points. The Forest Preserve Fund experienced the next largest growth of 325.0 percentage points over the five-year period. The aggregate UAAL of the ten funds combined was equal to 486.4% of their combined payroll in FY2012, up from 247.9% in FY2008.

The public pension reform packages passed by the Illinois General Assembly were designed to reduce local government funds’ unfunded liabilities over time. Additionally, for the Municipal and Laborers’ Funds, the legislation requires that each fund achieve 90% of the funding it needs to cover promised benefits by the end of 2055. The Park District legislation has been projected to result in 90% funding by 2049.