October 20, 2023

New data from the Illinois Gaming Board show that casino revenue gross receipts have continued their recent trend of annual growth, thereby increasing tax allocations to the State of Illinois and local governments. These data also offer first-month estimates of the City of Chicago’s inaugural casino, the temporary location of which opened Sept. 9, 2023, at the former Medinah Temple building. The revenue generated by the casino for Chicago will by State law be dedicated to the City’s police and fire pension funds. In the first month of operation, from Sept. 9 through Oct. 13, 2023, the new temporary Chicago casino generated $6.7 million in revenue, of which approximately $695,000 in taxes will go to the City of Chicago. While these increases are encouraging, the Civic Federation continues to urge government leaders to exercise caution in their reliance on gambling revenues and develop contingency plans to account for potential revenue instability.

This blog post will analyze the most recent Gaming Board data, looking at gross casino receipts and tax allocations during the three-year period from October 2020 through September 2023. The Illinois General Assembly’s Commission on Government Forecasting and Accountability released its 2023 analysis of gaming, Wagering in Illinois, last month, which includes analysis of lottery, video gaming, horse racing and sports wagering in addition to casino gaming.

Illinois Casino Gross Receipts and Tax Allocations 2020-2023

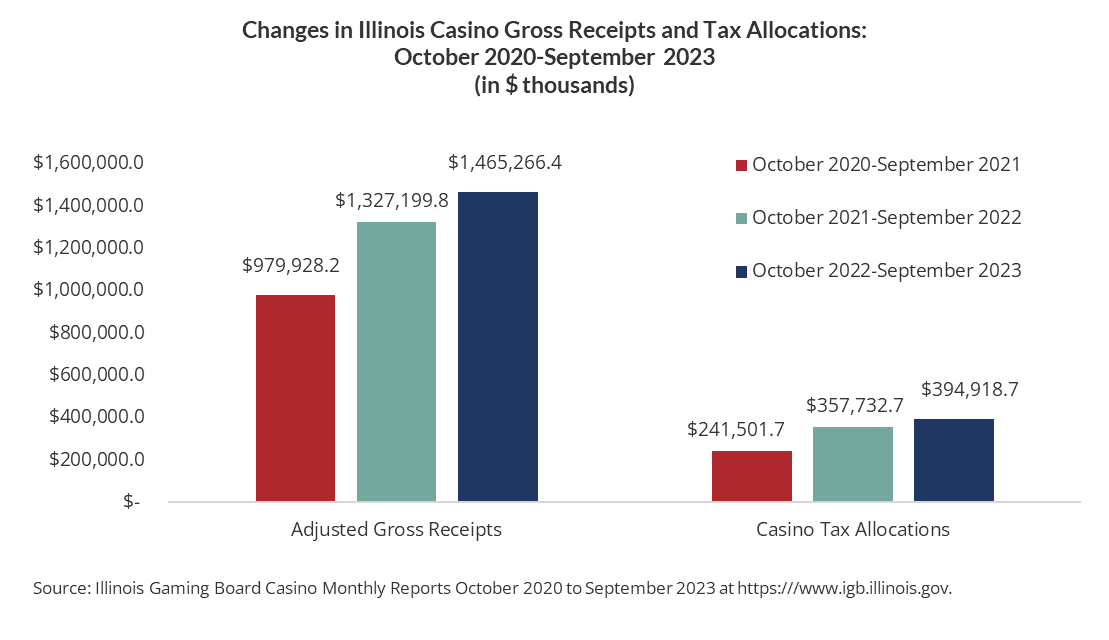

Illinois casinos were closed between March 16 and June 30, 2020, due to the COVID-19 pandemic. Consequently, revenues and tax allocations plummeted in 2020 from 2019 levels. By early 2022, however, with casinos fully in operation, casino finances have rebounded. The chart below shows year-over-year changes in adjusted gross receipts and tax allocations between October 2020 and September 2023, the last full month for which data are available. Adjusted gross receipts from casinos include gross receipts from both table games and electronic gaming devices, less any winnings paid out to gamblers.

Between October 2021 and September 2022, casino adjusted gross receipts continued their post-pandemic recovery, increasing 35.4% from the same time period the prior year to over $1.3 billion. This upward trend continued between October 2022 and September 2023, where receipts increased by $138 million, or 10.4%, to nearly $1.5 billion. State and local tax allocations from casino operations increased from $241.5 million between October 2020 and September 2021 to $395 million between October 2022 and September 2023.

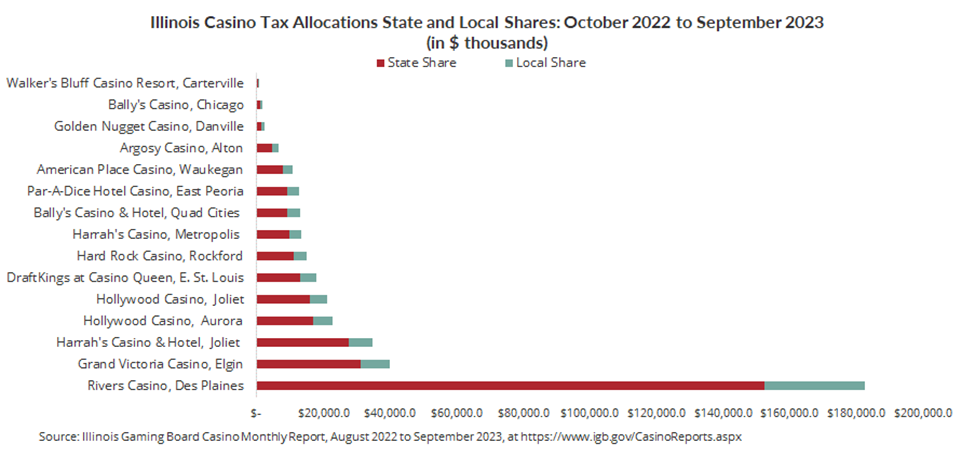

As of September 2023, there were 15 casinos operating in Illinois. The Illinois Gaming Board reported that in the one-year period between October 2022 and September 2023, total adjusted gross receipts from the State’s 15 casinos totaled nearly $1.5 billion. Rivers Casino in Des Plaines accounted for 37.2%, or $545.6 million, of that total amount. The casino reporting the second-highest amount was the Grand Victoria Casino in Elgin, with $152 million in adjusted gross receipts. Those reporting the smallest amounts are the two most recent additions: Walker’s Bluff Casino Resort in Carterville, which opened August 25, 2023, and Bally’s Casino Chicago, which opened September 9, 2023, and will be discussed in further detail below.

The next chart shows tax allocations distributed to governments by casino in the one-year period between October 2022 and September 2023, which totaled $394.9 million. Of that amount, the State share of the taxes was $311 million and the local share was $83.9 million.

Legislation Enacting the Chicago Casino and Its Taxes and Fee Rates

The Chicago Casino was authorized in the State of Illinois’ gaming expansion legislation passed in 2019 as part of Illinois’ $45 billion multi-year Rebuild Illinois capital plan. The capital plan included a “vertical” revenue bill for non-transportation construction projects, such as facilities, in Public Act 101-0031. This legislation authorized a number of different revenues to fund “vertical” construction projects, including a cigarette tax increase, a parking garage tax and sales tax from online retailers. The “vertical” revenue bill also authorized a massive expansion of gambling, including legalization of sports wagering at gambling facilities, stadiums and online; six new casinos around the State, including in Chicago; and expansion of existing casino facilities. The gaming expansion was expected to generate $350 million annually at full implementation, plus several hundred million dollars more in upfront liquor license fees for new and expanded gambling facilities.

Following the approval of the vertical revenue legislation, the City of Chicago expressed concern that the 33.3% tax burden it imposed on a city casino was too high to attract investors and would jeopardize the gaming funding stream for the non-transportation projects as well as the City treasury. In contrast, other municipalities only receive a 5% share of revenues.

In response to the City’s concerns, the General Assembly approved and the Governor signed Public Act 101-0648 in 2020, which replaced the originally enacted 33.3% City tax on post-payout revenue with a graduated tax structure on slot machines and table games, ranging from 10.5% of revenue up to $25 million to 34.7% of revenue greater than $1 million. It also increased the timetable for reconciliation fee payments for all Illinois casinos from two to six years and gave applicants a longer period of time to pay for a license if approved by the Illinois Gaming Board.

Chicago Casino Revenue Performance

Prior to the passage of the gambling expansion in 2019, leaders in Chicago had made a number of efforts to secure approval from the State for a casino in the City. More recently, those efforts were given additional weight by the need to identify a multimillion-dollar recurring revenue source to help pay for significant required increases in pension funding for the Police and Firefighter Pension Funds starting in 2015. The City of Chicago’s required contributions to the two pension funds were projected to increase by approximately $73.7 million in FY2024 from the prior year. The City estimated that once the Bally’s Casino was operational, it would generate up to $192 million in annual tax revenue. Bally’s also paid the City $40 million upfront in fees and will pay $4 million annually thereafter.

Since opening in early September, the City Casino has generated $6.7 million in adjusted gross receipts. The State’s share of the tax allocation totals $868,198 and the local share (to be generated for Chicago police and fire pensions) totals $694,913. The Mayor’s proposed FY2024 budget estimates that the Chicago casino revenue will account for $35 million of the total $1.5 billion contribution to the Police and Fire pension funds in 2024.

The Civic Federation has long had concerns over the City of Chicago’s proposed reliance on casino revenues as a major funding source for its Police and Firefighter Pension Funds. While a casino may generate some budgetary relief, gaming revenues can be unreliable, particularly over the long run, and should be budgeted with caution. Further, the State of Illinois currently has 15 casinos and thousands of video gaming locations. With six additional casinos enabled by the 2019 gaming expansion including the Chicago casino, the legalization of sports gambling and a growing number of video gaming locations, not to mention nearby casinos in neighboring states, there is greater potential for market saturation. Therefore, the Civic Federation cautions that the City will need to develop contingency plans to supplement unreliable casino revenue when planning for future pension contributions.