February 03, 2011

The State of Illinois is anticipating a large increase in revenues from income tax rate increases approved in January and additional resources from borrowing to make its pension payment for the second year in a row. Even so, the Governor and General Assembly are considering borrowing billions more before the end of the fiscal year.

The massive borrowing plan was introduced in the prior legislative session as Senate Bill 336 and has been reintroduced as Senate Bill 3 in the new 97th General Assembly. The proposal creates a new type of borrowing for the State called General Obligation Restructuring Bonds that would total $8.75 billion and be repaid over the next 15 years. The three-year budget plan released by the Governor’s Office of Management and Budget shows $4.3 billion of the proceeds being used in FY2011 to pay down the State’s accounts payable, which are expected to total $6.4 billion by the end of FY2011. The plan also calls for the State to use $1.5 billion of the proceeds to pay for General Funds operations in FY2012. The remaining $2.9 billion can be used for additional operations and liabilities of the state with very little restriction. The bill specifically mentions employee health care costs and corporate tax refunds, which are liabilities outside the General Funds of the State, as potential uses of the borrowing proceeds.

Also included in the bill are the dates that the principal amounts borrowed will be repaid. To accommodate the increased debt service costs associated with pension borrowing already approved in FY2010 and FY2011, the legislation proposes loan payments to be back-loaded into future years so that the State can afford the cost of the proposed GO Restructuring Bonds. When debt is back-loaded the State owes more principal for longer periods, which in turn increases the total debt service owed on the loan. Although this helps avoid annual debt service increases in the early years, it causes large increases in future years of the loan. The following chart shows that if the bonds were sold under current market conditions, it would cost a projected total of $3.4 billion in interest to the State over the next 15 years.

The estimates in the chart above are probably conservative for two reasons. First, the rates are based on market conditions as of January 25, 2011. As has been widely reported, interest rates for municipal bonds have been on the rise over the last month and are expected to continue to climb. The estimates also assume that the bonds will be sold as traditional tax-exempt municipal bonds. Tax-exempt bonds typically have much lower rates than taxable bonds because investors do not have to pay federal income taxes on the earnings from the bonds. The Internal Revenue Service enforces federal rules for issuance of tax-exempt bonds that limit the total amount of tax-exempt bonds a government may sell for operating funding. If the IRS found that some of the proposed bonds exceeded the State’s limit they would not qualify as tax exempt and the total debt service cost will increase.

Based on the estimates above, if the GO Restructuring Bonds are authorized by the General Assembly, then the State’s total annual debt service owed on all existing debt, including the FY2011 pension bonds, will climb to $4.4 billion by FY2015. According to the Governor’s FY2010 budget, before it issued the FY2010 pension bonds the State’s total debt service for that year would have totaled $2.0 billion. The following chart shows total debt service owed by the State for all outstanding debt combined with the pending pension bond sale for FY2011 and the estimated cost of the proposed GO Restructuring Bonds.

As previously discussed in this blog, the income tax increases approved in January are temporary; rates under the legislation roll back half way through FY2015 from 5.0% to 3.75% for the personal income tax and 7.0% to 5.25% for the corporate income tax. However, considering the increased spending pressures associated with the debt service levels shown above it could be very difficult for the State to both pay for its increased borrowing costs of more than $1 billion and absorb the loss of revenues associated with the tax rate rollback.

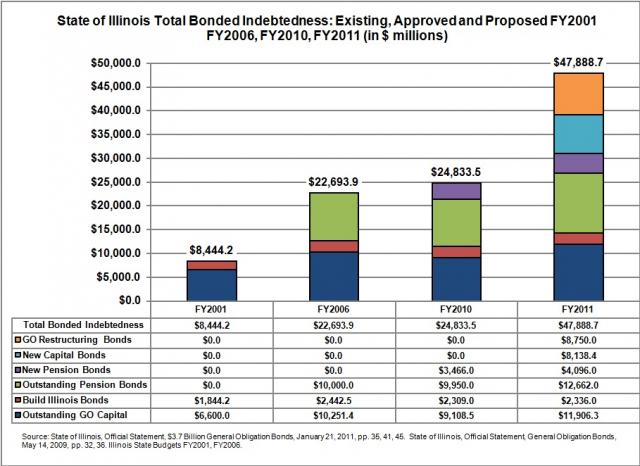

Meanwhile, the State’s total debt burden would increase dramatically due to this borrowing. The State has increased borrowing for pensions by more than $7 billion in the last two years. Borrowing for capital is also on the rise to support the State’s $31 billion capital spending program approved as part of the FY2010 budget. Along with the tax increase and pension borrowing, in January the General Assembly approved an additional $4.2 billion in capital bonds, bringing the amount of available capital debt approved but not issued to $8.1 billion. The following chart compares the State’s total existing debt in FY2011, including the authorized but unissued bonds and the proposed additional borrowing, with total debt levels two years, five years and 10 years prior.

If all of the new debt already authorized by the State is sold and the GO Restructuring Bonds are approved the State’s total debt will have increased by $39.4 billion, or 467.1%, over the last decade.