April 14, 2011

Although the State of Illinois' FY2011 tax amnesty program brought in more than $700 million of delinquent tax payments owed by taxpayers and business, only $12 million of that revenue can be considered new funds.

As previously discussed on this blog, the tax amnesty program approved by the Governor and General Assembly allowed payment of personal income tax, corporate income tax and sales tax owed to the State from previous years without the usual interest and penalties charged for late payment. The grace period also applied to other taxes collected by the State on behalf of local governments such as the personal property replacement tax and the municipal auto renting tax. The amnesty was only granted for taxes owed from FY2003 through the end of FY2009 and ran from October 1, 2010, through November 8, 2010. The legislation provided that fines would be doubled for delinquent tax payments still owed after the amnesty period ended. The last time the State approved a tax amnesty program was in FY2004.

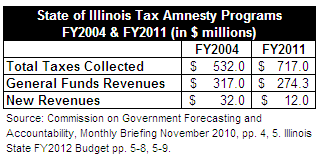

Early reports showed that the amnesty would most likely exceed the $250 million in expected General Funds revenues from the program included in the Governor’s proposed FY2011 budget. However, as noted by the Commission on Government Forecasting and Accountability in its November 2010 monthly briefing, only a small amount of the funds received under the program could be considered new revenues. Instead, the majority of the funds received are merely accelerated payments that would have been otherwise collected through the State’s normal tax enforcement efforts. For instance, of the total $532 million collected under the FY2004 program, the Department of Revenue determined that only $32 million of the total were new funds.

The following chart shows the results of the FY2011 amnesty program compared to the results of the program in FY2004.

The Governor’s recommended budget for FY2012 published in February 2011 reported $165 million of the total amnesty taxes collected would have otherwise been collected in FY2011. Another $150 million is attributed to expected collections in FY2012 and $390 million to subsequent years. Thus, only $12 million of the total amnesty collections in FY2011 can be considered new funds.

The FY2012 budget documents also show a reduction in General Funds revenues to account for the forgone fees and interest penalties of $121 million in FY2011 and $53 million in FY2012. After accounting for the losses in FY2011, the total net gain in General Funds receipts from the amnesty program is reduced to $153.3 million. The total FY2012 revenue loss will be absorbed by the State without the benefit of the offsetting amnesty collections.